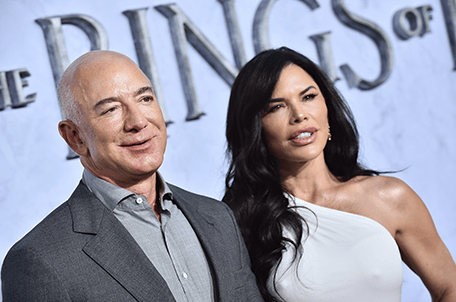

The recent announced divorce of Amazon founder Jeff Bezos from his wife Marianne of 35 years provides important lessons for all married couples; especially those of high net worth.

Understand the Laws Governing Divorce in Your StateState, not Federal Law, governs divorce — and each state has unique laws and legal precedents. In the Bezos’ situation, the fundamental difference occurs between equitable distribution and community property laws that govern distribution of marital assets.Broadly speaking, equitable distribution means that the courts have the ability to use their discretion in dividing property acquired by the parties. Thus, marital property (assets and liabilities acquired during the marriage) will be divided between the parties in a manner that the courts deem fair. There is no immutable rule determining who receives what or how much, even though the tendency is to divide assets equally appropriate. The court considers a large variety of factors such as relative earning contributions of the parties, the value of one spouse staying at home or raising the children, and the earning potential of each.

In community property states, the parties equally own all income, assets and debt earned or acquired during the marriage. Alaska (by agreement), Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin are community property states.

The Bezos’ divorce will be governed under the rules of their home state of Washington, a community property state.

High Net Worth Divorces Create Unique Situations

Individuals with high net worth often present a unique situation to their respective matrimonial attorneys. There are simply more financial resources to fund support and to share. Substantial business assets are often involved and extensive categories of personal expenses (including nannies, private schools, second and third homes and an affluent lifestyle) must be reckoned with.

Don’t ignore the reality that approximately 50% of all marriages end in divorce.

Marriage is not only an interpersonal relationship but also a financial relationship.

There is a saying that “when you have nothing, you have nothing to lose.” This may hold true with divorcing couples who started with nothing. When the Bezos’ married, Amazon was not in existence. This is not the case now.

As the Bezos are finding out with high wealth individuals, there is a lot to lose if planning is ignored. Nobody wants to disrupt their engagement with talk of planning for a possible divorce. To ignore long-established statistics is unwise, yet that is precisely what many individuals do. Families build a business and plan for business contingencies, yet they ignore interpersonal family crises that may interfere with the long-term viability of the family business. This doesn’t mean that all situations can be addressed through advance planning. As stated above, Amazon did not exist prior to the marriage. But in many cases, businesses are already in existence before “I do” is uttered, and the harm that can befall a business if ownership shares are divided can be anticipated.

Enter a premarital agreement before the marriage

Prenuptial agreements are one of the most effective tools in managing the exposure of one spouse’s significant assets to potential division. While a difficult subject to broach with your intended, a properly drafted premarital agreement can save the parties significant emotional and financial expense. These agreements can address property division, spousal support and virtually every financial issue that may arise during a divorce. High net-worth individuals that have a vested interest in protecting family assets and/or assets remaining from a prior divorce should especially consider a prenuptial agreement.

In fact, senior members of family businesses will often require young family members to enter such agreements before they will be granted full shareholder rights in the family business. If there is no premarital agreement in place, a divorce could expose the family wealth to possible division.

Assess and quantify the financial lifestyle of the marriage; identify and value assets and liabilities

It is critical to any divorce but especially to a high net-worth divorce to have a detailed understanding of the financial lifestyle of the marriage as well as the assets and liabilities of the marriage. For a business owner, someone involved in a family business, or an individual with complex investments, this is even more important. Only with a complete picture and awareness of each asset and liability can your attorney effectively act to limit your exposure to asset division.

As a preliminary step you should immediately schedule a meeting with your financial planner, accountant and attorney, to discuss the exposure of each asset to being divided. You will also need to analyze the tax consequences related to the methods of any distribution. With an understanding of what you have and owe, your attorney will be able to present your complex financial picture to the other party and to the court in a succinct and clear way. Because family courts are generally busy and have limited time to invest in any particular case, it is critical for your professionals to present a cogent plan of asset division to a judge, if the divorce cannot be settled by agreement.

Take appropriate business/asset planning steps

If you are a business owner or have an interest in a closely held business, you need to take steps to protect the business and your interest in the business from the effects of the divorce process. While it can be difficult to avoid involving the business in a messy divorce, it is possible to limit the exposure of the business to the interference of a non-titled spouse’s equitable claim for a piece of the business.

One way to do this is through a shareholder agreement clause that limits the transferability of stock in the event of a court order entered pursuant to a divorce. The shareholder agreement can also delineate business valuation methods, buy/back provisions and other terms designed to allow the titled shareholders to retain possession and/or limit damage caused by being forced to share the value of the company.

An Asset Protection Trust can be used to protect against changes in control of a company that may arise from unexpected family dynamics, such as divorce or the introduction of a new spouse into a business. The trust itself places ownership of the business into a trust with the intent to keep it outside the scope of divorce litigation.

Consult with your financial advisor/ estate planning attorney and hire the right experts including a forensic accountant to assist you in valuing and dividing your assets

The applicability of the above-described asset protection mechanisms should obviously be discussed with your accountant and lawyer together. It would be prudent to involve an attorney specializing in estate planning as well.

If your wealth is related to a business, or other personal assets that must be valued, an expert opinion is often needed. That expert is frequently a forensic accountant who will help to determine the value of a business. Sometimes the expert may be a specialty appraiser (such as a fine art appraiser). The different in achieving a satisfactory result or being led to an unreasonable settlement may come down to a battle of who has retained the most effective expert advisors to value and structure division of assets.

Don’t miss the opportunity to craft a reasonable settlement

High net worth individuals have a distinct divorce advantage over individuals with little net worth; they can afford the divorce. Lower and even middle income and lower net worth individuals struggle to find the funds to maintain two households, fund child support and alimony, provide for college and leave themselves something other than debt. High net worth litigants are able to get beyond subsistence planning during their divorce. They are not forced to incur legal and expert fees to merely survive financially. Therefore, there is almost always an opportunity to bend in settlement negotiations without financially jeopardizing your future or the future of your children.

Beware of Social Media

The immediate cause of the Bezos divorce was reporting on Jeff Bezos’ social media activity.

The explosion of the numerous forms of social media has in many ways created a potentially fundamental alteration of the way in which family law litigation is conducted. I have seen numerous cases where social media figured into a divorce — none it was helpful to the author of the posts.

Simple rule: Assume anything you email, post tweet or blog will be read by opposing counsel and possibly the Court in a divorce proceeding.

All materials in this article have been prepared for general informational purposes only. They are not intended and should not be construed or used as legal advice or legal opinion on any specific facts or circumstances. One should consult an attorney for advice regarding their individual situation since every case is unique. The information contained in this article is not intended to create, and receipt of it does not constitute, a lawyer-client relationship nor is it intended to substitute for the advice of an attorney.